Allen car title loans provide swift cash with vehicle titles as collateral, ideal for debt consolidation but requiring responsible management to maintain/improve credit scores. Missed payments lead to penalties, repossession risks, and harm to credit reports. Weighing terms, including flexible plans, is crucial before deciding if these loans meet financial needs.

In the financial landscape of Allen, car title loans have emerged as a unique borrowing option. But how do these secured loans impact your credit score? Understanding the relationship between Allen car title loans and your credit is crucial for informed decision-making. This article delves into the mechanics, exploring how these loans can enhance or damage your credit profile, providing insights to help borrowers navigate this alternative financing path wisely.

- Understanding Allen Car Title Loans

- How These Loans Affect Your Credit

- Enhancing or Damaging Your Credit Score?

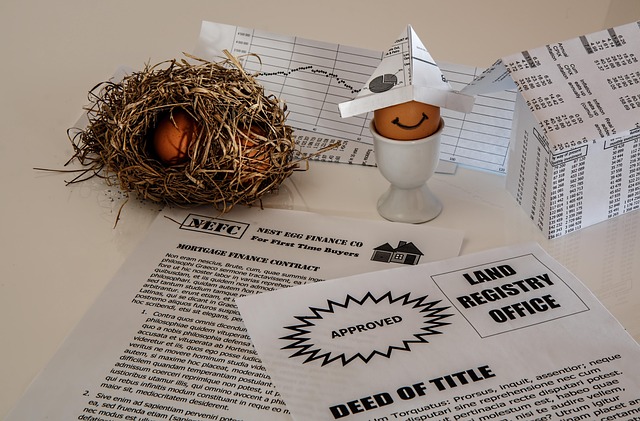

Understanding Allen Car Title Loans

Allen car title loans are a type of secured lending option where borrowers use their vehicle’s title as collateral. This innovative Financial Solution allows individuals to access cash quickly, often with same-day funding, without the need for complex credit checks. These loans are tailored to those in urgent need of funds and who may have limited options for traditional bank loans or credit lines. The process is straightforward; borrowers provide their vehicle’s title as security, allowing lenders to hold onto it until the loan is repaid. This swift and direct approach can be particularly beneficial for debt consolidation, helping individuals manage multiple debts by combining them into a single, more manageable repayment plan.

By utilizing Allen car title loans, borrowers gain access to immediate financial support, enabling them to cover unexpected expenses or seize opportunities without delay. However, it’s crucial to approach this type of lending responsibly. Repayment terms and interest rates vary among lenders, so careful consideration and comparison are essential. Understanding the terms and conditions ensures borrowers can effectively manage their loans and maintain a positive credit score while utilizing these alternative financial tools.

How These Loans Affect Your Credit

Allen car title loans can have a significant impact on your credit score, both positively and negatively. When used responsibly, these loans can provide a temporary financial boost, allowing individuals to cover unexpected expenses or bridge short-term gaps. Repaying the loan on time can actually enhance your creditworthiness by demonstrating timely debt management. Lenders often report positive repayment histories to credit bureaus, which can improve your FICO score over time.

However, the potential pitfalls of Allen car title loans are significant if not managed properly. Failure to repay the loan as agreed upon can lead to late payment fees and, eventually, repossession of the secured asset—in this case, your vehicle. Each missed payment or default can negatively affect your credit score, making it harder to secure future loans or credit cards. Additionally, loan extensions or refinancing might seem like a way out, but they often result in paying more interest over an extended period, further complicating your financial situation.

Enhancing or Damaging Your Credit Score?

When considering an Allen car title loan, it’s essential to understand its potential impact on your credit score. Unlike traditional loans that rely solely on your credit history and report, these secured loans use your vehicle as collateral. If managed responsibly, this can enhance your credit score by demonstrating timely payments and responsible borrowing. Lenders often report positive repayment behavior to credit bureaus, which can improve your overall creditworthiness.

However, if you miss payments or default on the loan, it could significantly damage your credit score. Late or missed payments may be reflected in your credit report, negatively impacting future lending opportunities. Moreover, failing to repay an Allen car title loan can result in repossession of your vehicle, causing further financial strain and a lasting effect on your credit history. Therefore, careful consideration and understanding of the terms and conditions—including flexible payment plans offered by some lenders—are crucial when deciding whether a vehicle collateral loan is the right choice for you.

Allen car title loans can have a significant impact on your credit score, either positively or negatively. While these loans offer a quick financial solution, they should be considered carefully due to their potential consequences. By understanding how these loans work and their effect on your credit, you can make informed decisions to enhance or protect your credit score. Remember, responsible borrowing is key to maintaining a healthy financial profile.